NeuroRank™ by Pulp Strategy

Control Your Equity Story Inside AI Search

From filing to aftermarket, your valuation is now AI-mediated. NeuroRank™ is the enterprise system that makes your equity story visible, accurate, and trusted inside ChatGPT, Gemini, Claude, Perplexity, and Google AI Overview.

- Global coverage (USA, Europe, APAC, India, MENA)

- IR-ready deliverables

- Secure, agentic audit workflow

Build By Pulp Strategy

NeuroRank™ maps how models remember your company, repairs misinformation, and conditions recall so investors, analysts, and media see the right facts at the right moment. For pre-IPO, IPO, and listed firms, it turns AI surfaces into a pricing lever and a reputation shield.

The Problem

Search has moved from clicks to answers. When investors ask AI systems for “best EV maker EBITDA trends” or “top fintechs before IPO,” they get synthesized outputs, not ten blue links. Those answers are driven by model memory: the entities, relationships, filings, and narratives LLMs trust. If your company is missing, misattributed, or framed by outdated headlines, you forfeit pricing power.

This is why LLM SEO and GEO now sit beside financials and banker outreach. Traditional SEO and PR remain necessary, but they no longer control what AI repeats. NeuroRank™ closes the gap with an equity-story-first approach: it structures filings, KPIs, leadership bios, and product facts as machine-readable truth; seeds them to the sources models cite; and reinforces recall with ongoing prompt tests.

Result: higher inclusion in AI answers, fewer false claims, and stronger confidence at listing and beyond.

Why It Matters Now

Analyst and trader research is now centered in AI Overviews and investor tools that combine price action, technicals, and model generated context. Based on observed behavior:

- They skim synthesized answers first and click sources only when a claim, KPI, or quote needs verification.

- They anchor to recency and first source. Fresh filings, earnings excerpts, and official IR pages cited by models carry more weight than older coverage.

- They triangulate across peers. If your company is missing from peer shortlists, the omission is treated as a negative signal.

- They react to consistency. Conflicts in leadership titles, ownership, or KPIs across answers reduce confidence and slow buying decisions.

- They use ticker linked prompts (for example, “Explain [TICKER] catalysts, risks, milestones”). If facts are not machine readable, models default to stale headlines.

- They scan AI overview panels as a quick proxy for coverage and relevance during fast markets.

- They prefer machine readable facts. Structured data, speakable FAQs, and clear schema accelerate due diligence and lower ambiguity.

NeuroRank aligns verified, machine readable facts with audited KPIs so models return accurate, current answers and name your company when it matters.

The NeuroRank™ Equity Story Engine

Human + Platform: Pulp Strategy’s strategy team leads; the NeuroRank™ platform accelerates analysis, validation, and reporting.

Product Modules

Engineer

Human-led semantic fact architecture, schema, and evidence packs authored by Pulp Strategy; the platform assists with patterns and validation (it does not draft filings or make legal interpretations).

Seed

Human editorial and IR execution for ecosystem publishing and source hardening; the tool provides target maps and citation monitoring.

Discover

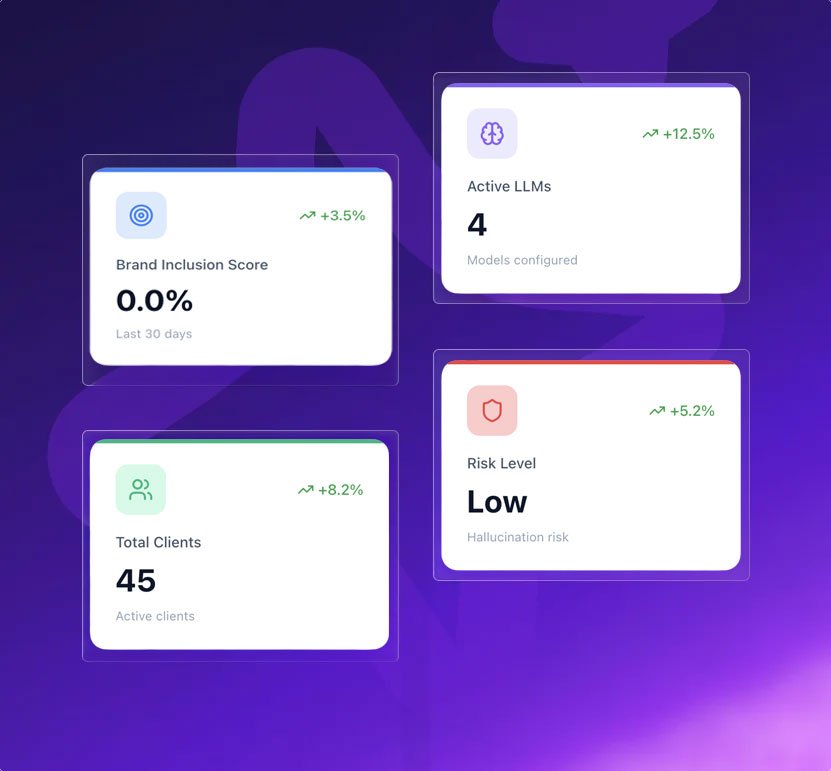

Strategist-led model recall audit using NeuroRank™ analytics; inclusion scoring and hallucination index.

Reinforce

Joint team+platform: continuous prompts, guardrails, drift checks with strategist review.

Report

Analyst-crafted executive dashboards, GEO coverage, ROI tracking generated via the platform.

Model Recall Audit

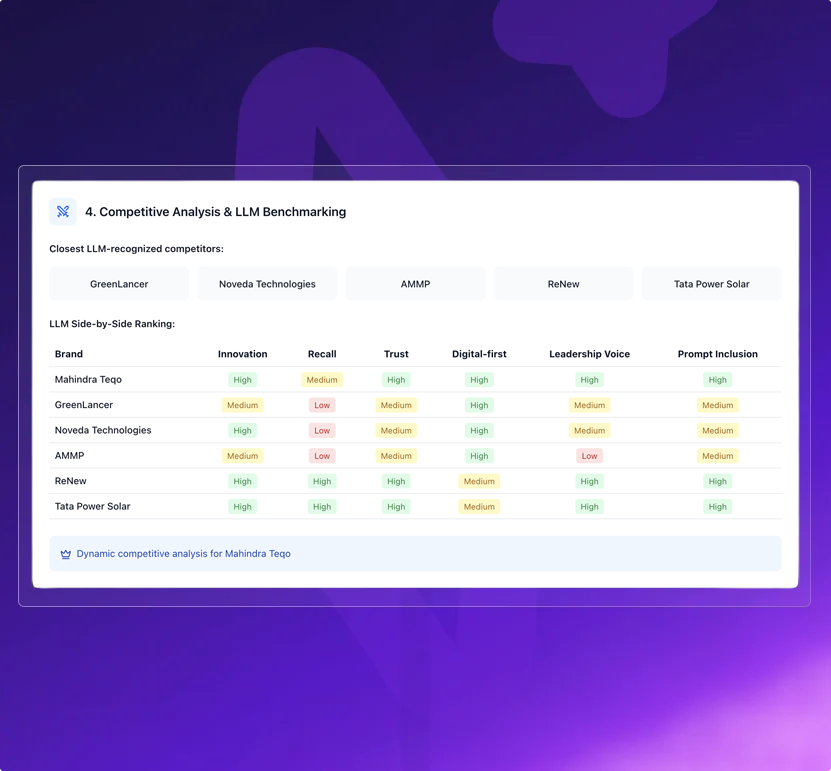

Led by Pulp Strategy analysts using NeuroRank™ diagnostics to baseline how ChatGPT, Gemini, Claude, and Perplexity describe your company across investor queries (category leadership, revenue vectors, governance, key risks, moats). We map omissions, errors, and misattributions by geography and language.

Semantic Fact Architecture

A human editorial process transforms filings, prospectus material, and approved IR narratives into AI-legible building blocks: entities, claims, sources, and time-bound facts. NeuroRank™ provides templates and validation. This is artificial intelligence search engine optimization for equities-built for verifiability, not hype.

Source & Ecosystem Seeding

Executed by Pulp Strategy and client IR/comms teams. We publish and reinforce your truth in places models trust: investor FAQs, newsroom posts, developer docs, data rooms, and high-authority forums. The platform supplies speakable answer patterns and schema checklists.

Knowledge Graph Stitching

Curated by the strategy team. We stitch relationships between brand, products, leadership, and milestones using structured data; the platform validates schema and entity connections. The result is a resilient graph that strengthens search engine optimization and raises trust in LLM outputs.

Live Conditioning & Guardrails

Operated jointly. We run periodic prompt suites (“ai mode”) across priority markets and compare answers to approved facts. Misinformation triggers human-reviewed fix-loops, while high-performing prompts get reinforced. Reporting shows Prompt Inclusion Score, Hallucination Index, and AI Overview presence by market.

What you get

- Equity Story Visibility Map

- Hallucination & Omission Report

- Prompt Inclusion Scorecard

- Fix Plan with Owners & SLAs

- IR content pack optimized for ai overview

Integrations

- CMS (WordPress/Headless)

- PR wire

- Analytics suites

- Data rooms (Investor Relations)

- SSO

- DAM

Compliance & Schema

- Schema.org (WebSite/WebPage, Service, SoftwareApplication, FAQPage, Speakable)

- E-E-A-T evidence,

- Provenance tagging

- Canonical/OG tags

Strategy & Methodology by Pulp Strategy

NeuroRank™ is the engine. The advantage comes from Pulp Strategy’s strategy practice that identifies gaps and designs methodologies to close them with lasting impact. We align IR, legal, comms, and product to a single equity story that AI can verify and repeat.

How we work

Gap Discovery Workshops

Cross-functional sessions to surface risk frames, missing claims, and high-value prompts.

Equity Narrative Architecture

Approved value story mapped to entities, metrics, milestones, and evidence.

Prompt Taxonomy & Journey Maps

stage-wise investor queries by region, sector, and buyer type.

Evidence & Source Playbooks

Create and harden proof assets (fact sheets, FAQs, filings extracts) with schema and speakable markup.

Governance & SLAs

Red-line reviews, release calendars, and model-drift checkpoints owned by named teams.

Capability Build

Train internal teams and agencies so practices persist beyond the first release.

Outcome: brands address challenges professionally and systematically, with long-range improvements to AI visibility, narrative control, and valuation confidence.

Use Cases by Stage

Pre-IPO (6-12 months out)

- Align prospectus narratives with machine-readable facts.

- Publish investor FAQs with schema and speakable answers.

- Seed leadership bios, governance stance, and key KPIs to trusted surfaces.

- Score and fix prompts like “top IPOs in [sector] this year.”

Roadshow & Pricing

- Ensure models elevate differentiators: unit economics, network effects, IP moat.

- Correct misattributions around ownership, subsidiaries, or legacy partnerships.

- Track Google AI Overview panels and reinforce missing facts.

Post-Listing / Secondary

- Maintain weekly prompt monitoring to catch drift.

- Publish machine-readable earnings, guidance changes, and milestone updates.

- Reduce volatility from rumor-driven frames by anchoring to audited sources.

BFSI & Regulated Sectors

- Build compliant ai for seo content packs with citations and review flows.

- Guarantee that fee structures, eligibility, or coverage details are correctly rendered by models.

Agency & Advisory Partners

- Use NeuroRank™ as an ai seo agency layer for clients: standardized audits, fixes, and reporting.

Across stages, the pattern is consistent: ai and seo together create durable recall in AI systems, while NeuroRank™ adds governance and proof.

Results & Social Proof

Programs using NeuroRank™ consistently show:

+63%

Prompt Inclusion

within 30 days (median).

75%

Fewer hallucinations

across GPT- and Gemini-class models.

22%

Faster velocity

from discovery to qualified conversation.

2×

AI-sourced pipeline

within a quarter.

These gains translate into valuation defense. When investors and media query AI, they see consistent leadership facts, clarified ownership structures, and recent milestones-all aligned to filings. The result is tighter spreads during book-building and steadier post-listing narratives.

EV OEM Case Study

Context:

A fast growing EV OEM preparing for financing milestones. Pre engagement checks found inconsistent ownership framing in public AI outputs and limited coverage of product leadership.

Problem:

Investor oriented prompts sometimes described a minority investment as subsidiary status. Some AI overviews emphasized older headlines and missed current KPIs and network expansion.

Approach with Pulp Strategy and NeuroRank:

- Analyst led recall audit across ChatGPT, Gemini, Claude, and Perplexity in India, USA, and Europe.

- Human authored semantic fact packs for leadership, unit economics, and manufacturing scale.

- Knowledge graph stitching of brand, product, and ownership entities.

- Source seeding to IR hubs, high authority forums, and speakable investor FAQs.

- Guardrails with quarterly prompt suites in “ai mode” and legal reviewed fix loops.

Observed results (pilot period):

- Higher prompt inclusion on priority investor queries.

- Fewer ownership frame errors in tested markets.

- AI overview panels reflecting updated milestones and product differentiation.

- Greater consistency across analyst and media summaries.

Implementation Cadence

- Day 0-30: Diagnostic, baseline recall, strategy and emergency fixes.

- Day 30-90: Content refactor, schema expansion, source seeding, first guardrail cycle.

- Monthly: Model drift checks, prompt re-testing, leadership updates.

- Ongoing: Earnings, guidance, product, and governance changes encoded as machine-readable facts.

Governance runs alongside IR and legal review with red-line workflows built for audited environments. Outputs fit your CMS and newsroom with minimal disruption.

Frequently Asked Questions

Across 50+ enterprise projects, NeuroRank™ system has shown clear and measurable gains:

What is NeuroRank™ for IPOs and listed companies?

A human-led, platform-assisted system that improves brand visibility and factual recall inside AI search (ChatGPT, Gemini, Claude, Perplexity, Google AI Overview). It applies LLM SEO and GEO to equity stories using only public and approved IR content.

Does this replace IR, PR, or traditional SEO?

No. IR manages disclosures, PR manages media, and SEO manages web visibility. NeuroRank™ adds an AI search layer so models recall accurate facts. Workflows run alongside IR/legal approvals.

What is GEO and how is it used here?

GEO (Generative Experience Optimization) structures entities, claims, and sources so AI systems generate accurate answers. It complements search engine optimization with AI-first patterns.

Which markets and languages do you support?

Coverage includes USA, Europe, APAC, India, and MENA. Language scope is set per engagement; English is standard, with localized prompts and governance where required.

What inputs do you need from us?

Public filings, approved IR pages, fact sheets, leadership bios, product documents, and a point of contact for legal/IR review. No non-public information is required.

How fast do programs start showing impact?

Fact-based answer: Week 1 baseline and risk map; fixes begin in Weeks 2–4; ongoing guardrails and reporting thereafter. Timelines vary by market scope and approval cycles.

What can you do during a quiet period?

Activities are limited to public, pre-approved materials and governance workflows. No speculative claims or forward-looking statements are created.

How is success measured?

Core KPIs: Prompt Inclusion Score, Hallucination Index, AI Overview Presence by market, Source Coverage, and Consistency Rate across titles/ownership/KPIs.

What integrations are available?

Core KPIs: Prompt Inclusion Score, Hallucination Index, AI Overview Presence by market, Source Coverage, and Consistency Rate across titles/ownership/KPIs.

Is this a tool or a service? Who does the work?

Pulp Strategy leads strategy, editorial, and governance (human). The NeuroRank™ platform accelerates diagnostics, validation, and reporting (software). Engineer/Seed/Knowledge Graph Stitching are human-led.

How is data handled and secured?

Public-source prioritization, read-only crawls for sensitive sections, SSO, audit logs, role-based access, least-privilege workflows. Periodic security reviews are standard.

How is pricing structured?

Pricing is on request. Packages: Single Market, Multi Market, Enterprise. Add-ons: Governance SLAs, Agency Enablement, Quarterly Model Drift Audits.

What is NeuroRank™?

NeuroRank™ is a human-led, platform-assisted system for AI search visibility. It audits how models recall your brand, engineers machine-readable facts, seeds trusted sources, stitches knowledge graphs, and runs ongoing guardrails.

Can NeuroRank™ be used for non-IPO or non-listed businesses?

Yes. It applies to B2B, B2C/D2C, SaaS, BFSI, and growth-stage companies. The equity-story focus here is tailored for IPOs and listed firms, but the same framework supports non-IPO use cases with adjusted prompts and governance.

Does the tool itself fix or rewrite our content?

No. Strategy, editing, approvals, and final content fixes are human-led by Pulp Strategy (with IR/legal review). The platform supports with diagnostics, templates, and validation; it does not author filings or make legal interpretations.

Who is responsible for ongoing improvements and governance?

Pulp Strategy leads ongoing audits, updates, and governance with your IR/legal teams. The platform tracks drift, flags inconsistencies, and produces reports for human decision-making.

How does NeuroRank™ function as a full-system defense against AI visibility gaps?

By combining diagnostics (Discover), human content and schema work (Engineer), ecosystem publishing (Seed), continuous testing and corrections (Reinforce), and executive reporting (Report). This end-to-end approach reduces omissions, incorrect frames, and stale facts across AI surfaces.

Be where capital makes decisions.

Run a NeuroRank™ Equity Story Diagnostic • Talk to an IPO Visibility Strategist

Be found. Be remembered. Start your AI visibility journey with NeuroRank™ today.

NeuroRank™ by Pulp Strategy. Built for AI Visibility. Designed for Growth.